Rise of Tap and Pay in Nepal- Unlocking the Future of Offline Payments

It’s the year 2028. Imagine you are driving in your electric car. While listening to your favorite playlist and driving along, you notice that your battery is low, and you simply pull over to the next charging station. With coffee in one hand, you stretch your other hand out of your window and pay the bill- WITH JUST A TAP.

Here the fact of the matter is; you don’t have to imagine, and you don’t even have to wait for the year 2028 to do that. It is already possible. In fact, it was possible since 1995. But in recent years, "Tap & Pay" technology, also referred to as contactless payment—is becoming more and more popular.

It's incredible to see how payment methods have evolved. The speed and efficiency of contactless payments not only make transactions faster but also enhance our daily experiences. No more searching for cash or cards – just a secure tap, and the payment is done.

Well then, how does “Tap & Pay” payment work, how safe and secure it is and how can you use this service? Before talking about Fonepay’s Tap & Pay service (offline payment), known as FoneTAG (Fonepay TAP & GO), let us first understand some fundamentals of contactless payments.

What is Contactless Payment?

Contactless payment is exactly how it sounds. It is a method of paying for goods and services that do not need physical contact. Contactless payments make use of near-field communication (NFC) technologies and radio-frequency identification (RFID) to securely exchange payment information. All you need to do is to place your smartphone or card near the payment terminal. This convenient method allows payments to be carried out using cards, smartphones, or even smartwatches.

Why contactless payment?

Consumer perspectives: Contactless payments are popular with customers because they are more beneficial than traditional card payments in terms of speed, safety, and convenience.

Business perspectives: Contactless payments are popular with businesses because they speed up the checkout process. It also allows hassle-free payment acceptance especially in crowded areas like petrol pumps, big supermarkets and so on.

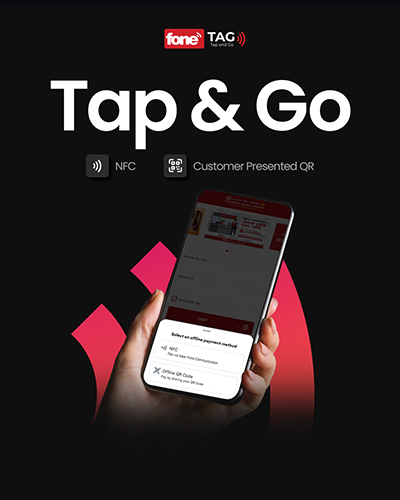

Fonepay’s Tap & Pay Service- FoneTAG

After being the industry leader in qr in Nepal ( ‘QR Payment’ ) and ‘Peer to Peer Fund Transfer’ domain, Fonepay has come up with one of its new offerings, FoneTAG (Fonepay TAP & GO). With Tap & Pay technology, Fonepay is aiming to address the pain point of expensive mobile data, unreliable or unavailability of internet connectivity during online transactions in Nepal.

We have seen a lot of firsthand cases where customers are reluctant to use digital payments because of expensive data and unsecured public WIFI. With Fonepay’s Tap & Pay method, customers can initiate offline transaction, in a very secured and convenient manner. The issue of offline payments in Nepal is likely to be solved with this service in near future.

What is FoneTAG?

FoneTAG is Nepal’s first offline payment solution that enables customers to make merchant payments by presenting NFC tag or a CPQR code (customer presented QR code) from mobile banking app even in areas with limited or no internet connectivity.

How to use FoneTAG?

Step 1: Open your Mobile Banking App

Step 2: Tap Offline Payments

Step 3: Tap either “NFC” or “Offline QR Code”

Step 4: Enter Transaction PIN or Biometric Scan to authenticate

Step 5: Ask Merchant to Scan QR to complete the transaction

For now, you can find this service active on Mobile Banking Application of Everest Bank.

Different methods for FoneTAG

NFC: With NFC tag, you can make offline payments at various NFC enabled Merchant Terminals with just one TAP. This feature requires enabling NFC and Contactless Payments in your phone. Look out for NFC symbols at the terminals.

Customer Presented QR (CPQR): Customer Presented QR is an alternative to NFC and an option for offline payments, if your phone does not support NFC and Contactless Payments. You can show this QR to Merchants, who can scan and receive payments on your behalf.

How does TAP & PAY Payment Work?

If you consider yourself as someone who wants to know “Behind the scenes” of everything, here’s some extra information for you.

Ever wonder how a payment is deducted from your account merely by placing your smartphone near the point-of-sale (POS) device?

From the outside, it all seems like a very simple process. You simply hover your payment card or smartphone near the payment terminal, and the transaction is completed. But behind the scenes, your smartphone or Debit/Credit Card engages in a sophisticated interaction with the payment terminal, facilitated by a technology known as Near-Field Communication (NFC).

In the case of smartphone devices, NFC starts with a small but mighty antenna instead of a traditional chip. This antenna responds to a radio signal from the card reader, similar to how an RFID chip would. The catch? This signal only works at a short range, just a few centimeters—hence the term "near field." So, when you bring your smartphone close to the card reader, the radio signal prompts the NFC antenna to share a unique, one-time code. This code acts as the green light for the payment processor to debit your account, and the best part? Your personal details and banking information stay safe because they're not sent over the airwaves.

Therefore, whether you're waving your smartphone or a card, it's this high-tech NFC handshake that's making your contactless payments happen.

.png)